The news has been full of talk about BlackBerry going belly up recently and BlackBerrys executives have done very little beyond a letter to try and change the sentiment. Now the Yankee Group has come out and said that BlackBerrys results do not show a company heading into bankruptcy. This seems to strengthen BlackBerrys claim that they have a solid balance sheet and are not disappearing anytime soon. They do this by comparing the sale of all BlackBerry 10 devices being higher than the Nokia Lumia, Motorola X and HTC One devices. Personally I think it is weird to compare all BB10 devices to a single model on Motorola or HTC but it does have a point.

Here is a quick summary of their main points on BlackBerry:

- has sold more BlackBerry 10 devices than Nokia Lumia, Motorola X and HTC One devices,

- retains significant cash on hand,

- has announced some notable recent customer wins, including KPMG just this week, and

- remains the gold standard in security, and its enterprise business continues to grow.

Check out an abstract of the report below:

BlackBerry’s Actual Results Refute Rumors of its Death

Carl Howe, Yankee Group

Oct. 17, 2013

The grave has been dug, the flowers have been sent and the casket is ready. There’s only one problem: BlackBerry isn’t dying, despite the doomsayers who insist it is.

Yes, BlackBerry announced bad earnings for the second quarter of its 2014 fiscal year, with revenue of only U.S. $1.6 billion, sales of 3.7 million smartphones and a loss of nearly U.S. $1 billion. This isn’t exactly a surprise; its new flagship BB10 phones have only been on the market for six months, and Blackberry had told markets it expected to operate at break-even at best for all of 2014. Sales of BlackBerry’s initial BB10 product, the Z10, have been disappointing in developed markets – hence the operating loss – and the firm announced it is set to go private in a U.S. $4.7 billion deal with its largest shareholder Fairfax Financial, pending completion of due diligence by Nov. 4, 2013.

But hold that funeral dirge for a minute. Consider the following facts that seem get routinely overlooked:

· BlackBerry is selling more phones than several other manufacturers. Nokia proudly states it sold over a million Lumia phones at the end of 2011, its first full year of Windows Phone availability. BlackBerry sold that many Z10s in its first quarter of sales. Even in BlackBerry’s so-called disastrous second fiscal quarter, sales of BlackBerry phones exceeded those of other high-profile phone launches such as the Motorola X and HTC One. If BlackBerry is dead, those companies should be too – and they aren’t.

· That near-billion-dollar loss is all non-cash. A close reading of BlackBerry’s earnings announcement shows that the vast majority of that loss is a write-down of unsold inventory, most likely early versions of BlackBerry’s Z10, the first BB10 device. BlackBerry now has hard-keyboard BB10 devices such as the Q5 and Q10 and a 5-inch Z30 touchscreen device, which should be more attractive to its e-mail and BBM-addicted target buyers. Further, the large write-down of unsold inventory in Q2 clears the way for better operating results in future quarters; BlackBerry now has much better data on its device demand and supply chain needs

· The company has U.S. $2.6 billion in the bank. Despite its troubled earnings, the company remains cash-rich and shows little sign of drawing down those assets. Unlike many other troubled companies, management appears to be working hard to live within its means, as exhibited by its hard-line Cost Optimization and Resource Efficiency program, and its plans to cut its workforce back to 7,000 employees. And the company is still winning customers: Consulting firm KPMG announced it bought 3,500 new BB10 devices and committed to BlackBerry Enterprise Server 10 just this week.

While BlackBerry going private with Fairfax or one of several other suitors won’t cure its operational ills, it will buy time for BlackBerry to cure those ills itself. BlackBerry CEO Thorsten Heins has told investors for two quarters now that he was leading a multi-year turnaround effort, not a multi-month one.

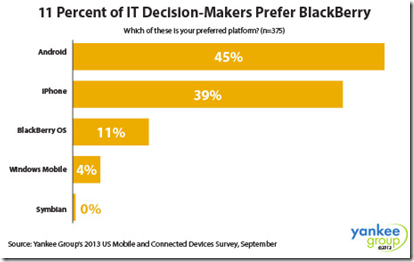

The upshot: It’s very difficult for a company like BlackBerry to go bankrupt when it has a multi-billion-dollar revenue stream from existing products and billions of dollars in the bank, regardless of how many reporters try to write its epitaph. We believe BlackBerry’s refocusing its efforts on the enterprise market and away from the consumer one is a sound strategy, and that BlackBerry still offers differentiated value for security-conscious businesses, many of which cannot accept the lower levels of security offered by competing platforms. Yes, BlackBerry is in the middle of a very difficult product transition, but it can quote Mark Twain to its customers, “Rumors of my death are greatly exaggerated.”

Carl D. Howe

Vice President, Research and Data Sciences

Yankee Group